Incorporating Forecast Accuracy in Financial Compensation Planning

Boost profit by aligning forecast accuracy with compensation. Learn about metrics, benefits, and target setting. Master financial planning now!

Modern pay planning lives at the intersection of people, budgets, and timing. When your forecasts are tight, compensation becomes predictable, fair, and easier to explain. In 2025, only 61% of U.S. CFOs plan raises of 4% or more, a 29% drop in two years. Mature planning can trim labor costs by up to 20% and lift productivity by 15%. For finance and HR, forecasting isn’t paperwork; it’s how you keep budgets nimble, hire confidently, and pay transparently.

This guide shows how to weave forecast accuracy into compensation planning—so Finance and HR can align decisions with confidence.

At a Glance

- Modern pay planning needs to align people, budgets, and timing to create predictable, fair compensation.

- Traditional forecasting metrics like MAPE and RMSE fall short because they don't account for the unique complexities of compensation, such as plan mechanics, timing, and geo shifts.

- To improve accuracy, focus on compensation-specific metrics like bonus payout variance, headcount ramp variance, and geo/level mix effects.

- A repeatable framework involving mapping drivers, running scenarios, and measuring accuracy can help you make pay decisions that match reality.

- Integrated platforms like CandorIQ can automate these processes, saving time and ensuring pay decisions are defensible.

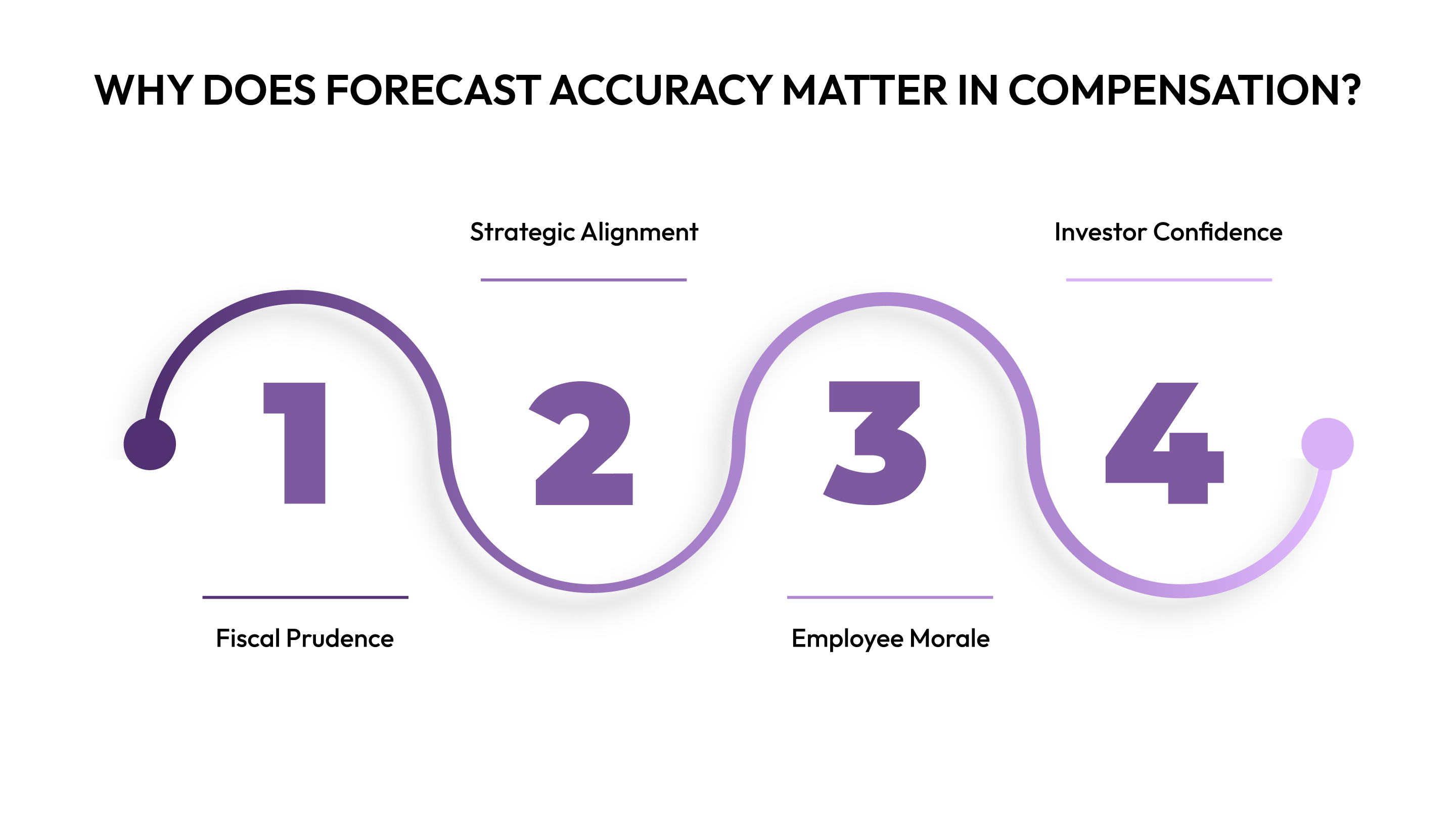

Why does Forecast Accuracy Matter in Compensation?

Your revenue and headcount forecasts set compensation budgets. Budgets power payouts across merit, bonus, and equity. Payouts are audited against plan and policy. The audit informs the next forecast. Accuracy at the start keeps each turn of this flywheel smooth and defensible.

A few key reasons why accuracy is paramount include:

- Fiscal Prudence: Accurate forecasts prevent budget overruns. Misjudging hiring velocity or promotional cycles can lead to unexpected spikes in payroll costs, impacting profitability.

- Strategic Alignment: When financial projections align with business goals, leaders can make informed decisions about market expansion, product development, or R&D investment.

- Employee Morale: Inaccurate forecasts can result in mismanaged bonus pools or delayed promotions, which can hurt employee morale and lead to increased attrition.

- Investor Confidence: For public or venture-backed companies, precise financial forecasts, particularly for major expenses like compensation, build trust with investors.

You're probably used to looking at high-level financial metrics in your forecast planning, like revenue growth or operational expenses. These are great for a top-down view, but they're not built for the fundamentals of compensation planning.

Why Traditional Forecasting Metrics Fall Short of the Compensation Mark?

Mean Absolute Percentage Error (MAPE)/Root Mean Square Error (RMSE) tells you how “off” a number was. But, compensation planning needs to know where, when, and what that miss does in dollars and people.

Why the usual metrics miss the mark:

- They ignore plan mechanics. Bonus plans have thresholds, multipliers, and caps. A small revenue miss can trigger a big payout change. MAPE won’t show that non-linearity.

- They aren’t dollar-weighted. A 10% error on a 20-person team is not the same as 10% on a 500-person org. Use exposure-weighted metrics.

- Direction matters. Over-forecasting vs. under-forecasting has different costs (accrual overhang vs. morale hits). Symmetric metrics hide this bias.

- Timing is invisible. You can be “accurate” for the quarter and still miss payroll cutoffs due to start-date slippage or late approvals.

- Mix effects get lost. Geo shifts, level mix, and acceptance rates change salary pools even if topline headcount is “accurate.”

- Granularity is wrong. Roll-ups can look fine while one Business Unit (BU) is way off. You need accuracy by org, job family, and location.

- No scenario awareness. Traditional metrics don’t test how accuracy holds under ±5% revenue or hiring freezes, exactly when plans break.

- Workflow risk is unmeasured. Metrics ignore approval latency, Applicant Tracking System (ATS)/Human Resources Information System (HRIS) sync gaps, and offer renegotiations that move payroll.

- No equity or fairness signal. You need to see if variance drives band drift, uneven payouts, or refresh delays, not just error size.

- They can be gamed. Smoothing forecasts may improve MAPE while making plans less responsive to reality.

As a founder, your time is your most valuable asset. Focusing on the right metrics helps you quickly identify where your plan is off track.

.png)

Also Read: Effective Compensation Benchmarking for HR Teams in 2025

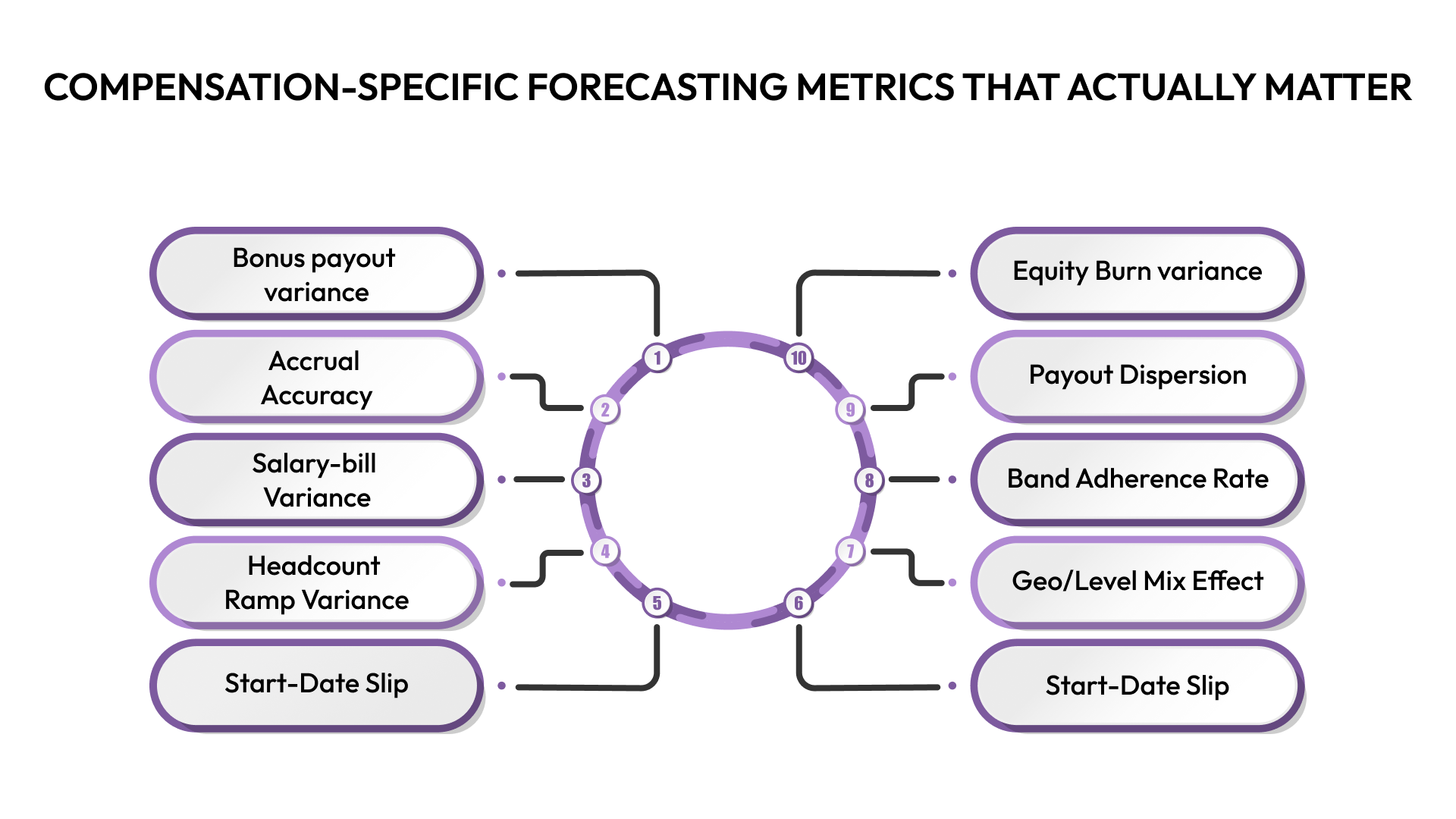

Compensation-Specific Forecasting Metrics That Actually Matter

Compensation-specific metrics bridge the gap between statistical accuracy and practical utility. Here’s a practical, comp-native metric set you can use right away. Each item says what it measures, how to compute it, when to check it, and what to do if it’s off.

1) Bonus payout variance %

- What: Gap between forecasted and actual bonus payouts.

- Formula: (Actual bonus $ − Forecast bonus $) ÷ Forecast bonus $ × 100.

- Cadence: Monthly during accruals; final at quarter/year end.

- Good target: Within ±3–5% by business unit.

- Act, if off: Review revenue/attainment drivers, plan thresholds, and team multipliers; re-cut accrual rules.

2) Accrual accuracy % (by BU)

- What: How close bonus/commission accruals are to actuals.

- Formula: 1 − |Actual accrual $ − Forecast accrual $| ÷ Actual accrual $.

- Cadence: Monthly close.

- Good target: ≥95%.

- Act, if off: Tighten inputs (attainment, quota changes), shorten approval lags, and lock cut-off dates.

3) Salary-bill variance % (plan vs. payroll)

- What: Drift in base-pay spend.

- Formula: (Actual payroll $ − Planned payroll $) ÷ Planned payroll $ × 100.

- Cadence: Monthly.

- Good target: ±1–2%.

- Act, if off: Check geo mix, promotions, off-cycle adjustments, and start-date slips.

4) Headcount ramp variance

- What: Gap between planned and onboarded heads.

- Formula: (Onboarded FTEs ÷ Planned FTEs) − 1.

- Cadence: Weekly during hiring pushes; monthly roll-up.

- Good target: ≥90–95% of plan.

- Act, if off: Unblock req approvals, speed offers, and align start dates with payroll cut-offs.

5) Start-date slip (days)

- What: Timing risk that moves payroll.

- Formula: Median (Actual start date − Planned start date).

- Cadence: Weekly.

- Good target: ≤5 days median; low tail risk.

- Act, if off: Compress approvals, pre-clear background checks, adjust onboarding windows.

7) Geo/level mix effect ($ and %)

- What: How composition shifts change salary pools.

- Formula: Recalculate payroll using planned vs. actual geo/level mix; report delta.

- Cadence: Monthly.

- Good target: ≤1% of salary bill.

- Act, if off: Rebalance hiring locations or adjust geo factors and band guidance.

8) Band adherence rate

- What: Share of offers/adjustments within approved bands.

- Formula: In-band actions ÷ Total actions.

- Cadence: Monthly.

- Good target: ≥95%.

- Act, if off: Refresh market data, fix outlier requests, and tighten approval routing.

9) Payout dispersion vs. policy

- What: Fairness signal vs. stated plan rules.

- Formula: Std. dev. of payouts within peer cohort vs. expected range.

- Cadence: Each cycle.

- Good target: Within policy range for cohort size and performance spread.

- Act, if off: Revisit multipliers, calibration, and exception handling.

10) Equity burn variance (vs. plan)

- What: Gap in refresh/new-hire equity usage.

- Formula: (Actual equity grants $ or units − Plan) ÷ Plan.

- Cadence: Quarterly.

- Good target: ±10%.

- Act, if off: Shift cash/equity mix, adjust refresh cadence, and tune leveling.

You can use a single platform like CandorIQ as your comp control panel to keep forecasts accurate, budgets steady, offers consistent, and outcomes clear.

Knowing which metrics to track is only half the battle. You also need a solid process to act on that data. This is about creating a repeatable system that ensures your pay decisions match reality. So, how do you go about building this kind of framework?

Also Read: How to Develop a Comprehensive Compensation Strategy: Practical Guide

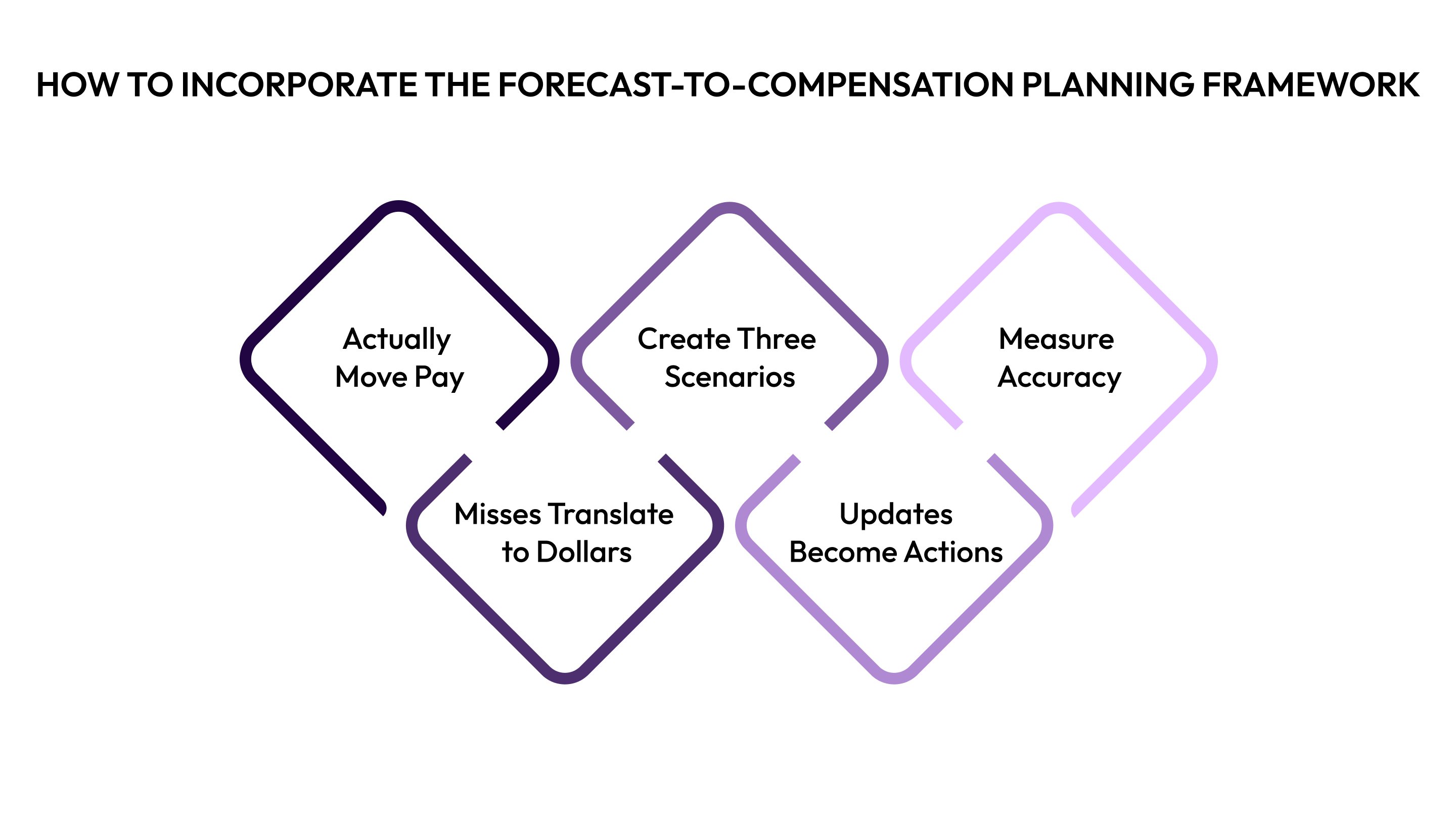

How to Incorporate the Forecast-to-Compensation Planning Framework

You want your pay decisions to match reality. Here’s a simple, repeatable path you can run every month or quarter.

Step 1: Map the Drivers that Actually Move Pay

Goal: See which business inputs change bonus, salary, and equity.

- List revenue drivers: ARR growth, product mix, big renewals, and geography.

- List headcount drivers: approvals, time-to-fill, acceptance rate, start-date slip, attrition, promotions.

- Add location factors: which cities or bands raise or lower salary pools?

- Write one line for each driver: “If X moves by Y, compensation changes by Z.”

Quick example:

“A 5% ARR miss cuts the bonus pool by ~12% because team multipliers drop below threshold.”

Step 2: Run Sensitivity so Misses Translate to Dollars

Goal: Turn abstract forecast error into a clear budget impact.

- Build a simple matrix: revenue at −10%, −5%, 0%, +5%, +10%.

- Add outputs for each case: bonus pool ($), merit spend ($), and equity refresh units.

- Do the same for hiring timing: on-time, −4 weeks, +4 weeks.

- Call out non-linear spots such as thresholds, caps, and multipliers.

Quick example:

“Hiring 50 people two months early at $100K adds ≈$500K in accelerated cash costs.”

Step 3: Create Three Scenarios with Clear Trigger Points

Goal: Know when to shift gears, not just how.

- Conservative (≈90% confidence): slower revenue, slower hiring. Trim pools, delay some merit, and add targeted retention.

- Base (≈50% confidence): planned programs with small tweaks.

- Optimistic (≈10% confidence): faster hiring, stronger retention, possible extra equity.

Set triggers you should honor:

- Revenue <95% of plan for the quarter → move to Conservative.

- Attrition >15% in a month → unlock retention budget.

- Call out seasonality (Q4 revenue spikes, Q1 attrition bumps).

Step 4: Lock Governance so Updates Become Actions

Goal: Every forecast change triggers the right comp move.

- RACI (Responsible, Accountable, Consulted, Informed)

- Finance: revenue forecast, accrual math, budget guardrails.

- HR/People Ops: headcount plan, bands, cycle setup.

- Sales/RevOps: pipeline and commission inputs.

- Executives: scenario approvals and policy calls.

- Monthly variance review

- Compare plan vs. actual for payroll, bonus accruals, and headcount ramp.

- Decide: adjust pools, shift merit timing, pause or accelerate hiring.

- Capture root causes and update assumptions.

- Data flow

- Keep req → approval → offer → start → payroll in one system.

- Version bands and log rationale for audits.

Step 5: Measure Accuracy and True-up the Budget

Goal: Track the signals that matter to compensation.

- Accuracy set

- Bonus payout variance %

- Accrual accuracy % by business unit

- Salary-bill variance %

- Headcount ramp variance and median start-date slip

- Equity burn vs. plan

- Bias check: Are you consistently high or low by org or location?

- Cadence

- Monthly: accuracy review and fixes.

- Quarterly: variance deep dive and driver re-weights.

- Annually: budget true-up, plus a “what helped most” review.

CandorIQ unifies ATS/HRIS/payroll, auto-computes comp metrics, enforces geo-adjusted bands, runs bonus/salary/equity scenarios, logs approvals, and answers with AI, turning forecasts into fair, timely, defensible pay.

Now that you have a framework for accurate planning, let’s talk about some of the common challenges you can face.

Also Read: Top Compensation Management Strategies for Employee Retention

Common Compensation Forecasting Pitfalls And How to Avoid Them

You're busy, and it's easy to fall into common traps. Recognizing and avoiding them can save you a lot of headaches and a lot of money.

You've seen the pitfalls and the metrics that matter. Now, it's time to put it all together.

Also read: A Comprehensive Guide to Conducting Compensation Analysis

Getting Started: Your 90-Day Implementation Roadmap

You don't need to overhaul your entire system overnight. Here’s a simple 90-day plan to get you started on the path to better compensation forecasting.

Days 1–30: Assess & Build the Foundation

- Form the core team: CPO/People Ops, CFO/FP&A, HRBP, RevOps/Sales Ops, Recruiting lead.

- Audit the last 12 months: Revenue, headcount, and comp variance. Note when/why misses happened.

- Set baselines: Bonus payout variance %, accrual accuracy %, salary-bill variance %, headcount ramp accuracy, median start-date slip.

- Map the workflow: Req → approval → offer → start → payroll. Flag handoff gaps and rework.

- Check integrations: ATS↔HRIS, CRM↔accounting, planning tool feeds. List quick wins.

- Align thresholds: What variance is acceptable by BU and the program? Write it down.

- Pick targets for 90 days: Choose 5 KPIs to track and improve.

You can use integrated platforms like CandorIQ to connect ATS/HRIS/payroll, import geo-adjusted bands, set roles, and enable version history.

Days 31–60: Implement Process & Governance

- Stand up a forecasting squad: Meet monthly; publish a one-page agenda and actions.

- Run a monthly variance review: Show the 5 KPIs, root causes, and fixes. Keep it to one page.

- Create scenario templates: Revenue ±5/10%, hiring slip ±4 weeks, acceptance rate ±2pp.

- Define triggers: e.g., revenue <95% of plan → tighten bonus pool; attrition >15% → activate retention.

- Launch dashboards: Automate feeds; kill manual reconciliations where possible.

- Plan comms: Explain bonus assumptions, merit timing, and what changes if triggers hit.

- Pilot one BU: Test the process end-to-end; capture lessons.

With CandorIQ, you can build scenarios for bonus/salary/equity, turn on alerts, route approvals, and log rationale.

Days 61–90: Optimize & Measure

- Turn on real-time alerts: Notify owners when KPIs breach thresholds.

- Run a quarterly sensitivity check: Compare scenarios to actuals; reweight drivers; update triggers.

- Document the playbook: RACI, handoffs, SLA targets, and report pack.

- Lock the cadence: Monthly accuracy review, quarterly deep dive, annual true-up.

- Track success:

- Comp budget variance ↓ 30–50%

- Manual analysis time ↓ 40–60%

- Faster decisions by 2–3 weeks

- Better employee confidence in bonus/merit comms

With CandorIQ, you can save scenario templates, schedule KPI reports, and use AI Agent to surface bias by org and geo.

The bottom line is to start small, measure weekly, act on triggers, and keep decisions in one system. The result is tighter forecasts and pay decisions you can stand behind.

Also Read: Compensation Management Software Guide for HR Teams in 2025

Conclusion

Forecast accuracy in compensation planning is about building a predictable, trustworthy, and scalable business. This is how you, as CFOs / FP&A Leaders, can keep your budgets nimble, hire with confidence, and ensure pay is transparent and fair.

A single, unified platform like CandorIQ can be your central command center for this entire process. It unifies your ATS, HRIS, and payroll data, automates compensation-specific metrics, and lets you run detailed scenarios for salary, bonuses, and equity.

By doing so, you turn abstract forecasts into defensible, timely, and fair pay decisions that you can stand behind.

Ready to build a compensation strategy you can trust? Book a demo with CandorIQ to see how you can unify your data, align your teams, and turn your forecasts into a strategic advantage.

FAQs

1. Which drivers most affect bonus accrual accuracy?

The biggest drivers are attainment, quota changes, and approval lags. A small miss in revenue can trigger a big payout change due to the non-linear nature of bonus plans.

2. How often should you re-forecast headcount and compensation?

You should re-forecast monthly. A monthly variance review helps you compare your plan against actuals for payroll, bonus accruals, and headcount ramp. Quarterly, you should do a deeper dive to true-up the budget and re-weight drivers.

3. What’s the difference between forecast accuracy and bias in pay planning?

Accuracy tells you how "off" a number was. Bias refers to the direction of the error, whether you are consistently over-forecasting or under-forecasting. Bias is important because over-forecasting has different costs than under-forecasting (e.g., accrual overhang versus morale hits).

4. How do geo-adjusted bands change the accuracy targets?

They introduce a new layer of complexity because they change salary pools even if the overall headcount is accurate. Your accuracy targets must now account for how shifts in geographic location or job level composition affect your budget.

Ready modernize your workforce and compensation strategy?

See how CandorIQ brings workforce planning and compensation together with AI.