Understanding Indirect Compensation: A Comprehensive Guide

Learn about indirect compensation and how it impacts employee benefits. Explore types, examples, and its role in enhancing workplace satisfaction.

Are your benefit costs truly driving retention, or just draining budgets? As scaling organizations navigate competitive talent markets, indirect compensation has become the silent differentiator.

Benefits now account for approximately 29.8% of total employer costs per hour worked, yet many mid-sized companies lack clarity on what they're offering or how it impacts their bottom line.

For CPOs and CFOs managing distributed teams with lean resources, fragmented compensation planning creates budget blind spots and missed opportunities. This comprehensive guide demystifies indirect compensation, helping you structure benefit packages that attract top talent while maintaining financial discipline and governance.

At a Glance

- Indirect compensation includes non-cash benefits like health insurance, retirement plans, PTO, and lifestyle perks, making up about 30% of total employer costs.

- Retention impact: Employees who understand their benefits are 4x more likely to stay beyond three years. Replacing talent costs 150-200% of salary, while comprehensive benefits cost just 25-35%.

- Strategic benefits design focuses on key areas that address your talent challenges (e.g., equity for startups, health plans for established firms, flexibility for distributed teams).

- Six core benefit categories drive outcomes: health/wellness (baseline credibility), retirement (loyalty), time-off (burnout prevention), professional development (growth signal), lifestyle perks (daily value), and recognition (culture reinforcement).

- Implementation matters more than selection: Weak communication, lack of personalization, invisible benefits, and unsustainable financial models lead to failed programs.

- Visibility problem: Fragmented compensation data makes it harder to make informed talent decisions and causes employees to undervalue benefits.

What is Indirect Compensation?

Indirect compensation includes all the non-cash perks employees get, things like health insurance, paid time off, retirement plans, and flexible work hours. These benefits add real value but aren't part of the paycheck.

While they can't be spent like cash, perks such as company cars, childcare support, and stock options can be just as valuable. For growing companies, indirect compensation plays a big role in labor costs, talent attraction, and retention.

For CPOs and CFOs managing compensation budgets, understanding the differences between direct and indirect compensation is essential for strategic resource allocation and competitive positioning.

Direct vs. Indirect Compensation: Understand the Strategic Balance

Direct compensation is immediate and tangible, the dollars that hit employee bank accounts. Indirect compensation, however, builds long-term value and addresses broader employee needs beyond monthly expenses.

Here's how they compare:

For growth-stage organizations, the strategic balance between these two compensation types determines both your cost structure and your employer brand. Unified platforms like CandorIQ can provide a comprehensive view of your compensation.

While direct compensation gets candidates in the door, indirect compensation often determines whether they stay, and whether your total rewards investment delivers measurable ROI.

.png)

Read More: Comprehensive Guide to Salary Benchmarking Compensation

How Indirect Compensation Makes Your Talent Strategy

Most companies focus on salary, but it's the benefits that truly make a difference in retaining top talent. Employees who fully understand and value their benefits package are four times more likely to stay beyond three years.

The Edge You Need in Talent Acquisition

In today's competitive job market, salary alone won't seal the deal. It’s the benefits that get candidates to sign the offer letter. Top talent looks at the whole package:

- Healthcare cost-sharing: What’s the real cost to the employee versus what the company covers?

- Retirement contributions: How does the employer match help secure their long-term financial future?

- Work-life balance: Can they use their PTO without guilt?

- Career growth: Will the company invest in their professional development?

If your offer highlights a competitive salary but buries a $15K 401(k) match and an $8K health premium contribution in fine print, you risk losing the best candidates to competitors who make their total compensation package crystal clear from the start.

Why Indirect Compensation Drives Retention

You’ve probably seen the pattern: strong hiring momentum in year one, but attrition creeping up in year two, and costly turnover by year three. Why does this happen? Employees don’t always realize the value of their benefits until they need them. By then, they may already be considering other opportunities.

Indirect compensation plays a key role in improving retention in three ways:

1. Financial Security = Staying Power

Comprehensive health coverage and retirement matching provide employees with real financial security. When benefits are strong, employees have a solid reason to stay; leaving means losing their coverage, vesting schedules, and the peace of mind that comes with knowing they’re taken care of.

2. Lifestyle Flexibility = Lower Burnout

Generous PTO and flexible work arrangements allow employees to maintain a healthy work-life balance. When your benefits support personal time, your team can avoid burnout, stay productive, and remain engaged long-term.

3. Development = Long-Term Commitment

Tuition reimbursement, professional development stipends, and leadership training show that you’re invested in your employees' futures. It shifts their mindset from "just a job" to "a career path," keeping them with you for the long haul.

For companies with distributed teams or operating in tight talent markets, indirect compensation is not a luxury; it’s a necessity. The difference between companies that "offer benefits" and those that "leverage benefits strategically" is clear. It shows how long employees stay, how strong your brand is, and how much talent you can attract and retain.

Understanding why indirect compensation matters is one thing. Knowing how to design it strategically is another.

Also Read: A Comprehensive Guide to Startup Compensation and Equity

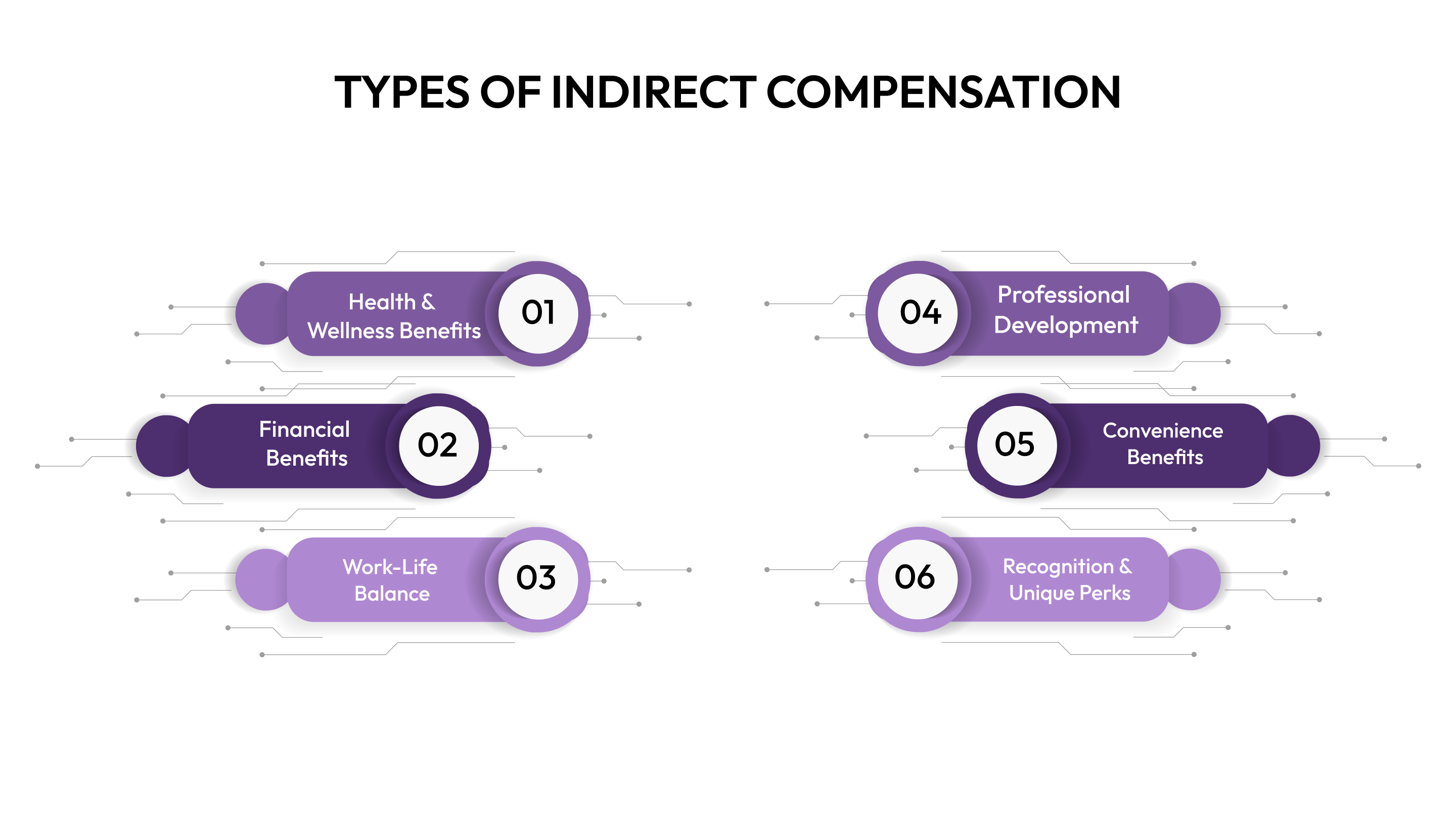

Types of Indirect Compensation

The most effective benefits programs go beyond copying competitors—they're tailored to your employees' needs, life stages, and your company’s unique retention goals. Here’s a practical breakdown of the essential categories of indirect compensation.

1. Health and Wellness Benefits: The Foundation of Financial Security

These benefits aren’t just perks; they’re crucial to attracting and retaining employees. Weak health coverage can turn off top candidates, especially those with families or health concerns.

Core Health Coverage:

- Health insurance (medical, dental, vision)

- Prescription drugs

- Mental health services

- Preventive care and wellness screenings

Extended Health Support:

- HSAs, FSAs, and EAPs

- Telemedicine

- Gym memberships

- Disability insurance and life coverage

Strategic Note: High-deductible plans with strong HSA contributions work well for younger, healthier teams, while families value low-deductible PPO plans despite higher premiums.

2. Retirement and Financial Benefits: Building Long-Term Loyalty

Retirement benefits create loyalty by tying employee success to company stability.

Core Programs:

- 401(k), 403(b), pensions

- Employer matching

- Profit-sharing

- Stock options and ESPPs

Financial Wellness:

- Financial planning services

- Student loan repayment assistance

- Emergency savings programs

Strategic Note: A strong vesting schedule is key for retention. If you're losing people after 2-3 years, revisit your vesting strategy.

3. Time-Off and Work-Life Balance: The Sustainability Factor

Burnout can creep up before you even notice. Time-off benefits help prevent it.

Paid Time Off:

- Vacation days

- Sick leave

- Parental leave

- Bereavement leave

- Sabbaticals

Flexibility Programs:

- Remote work options

- Flexible schedules

- Unlimited PTO policies

Strategic Note: Keep an eye on PTO usage. If employees aren’t taking enough time off, it’s a sign your culture isn’t supporting the benefits you're offering.

4. Professional Development: The Career Growth Signal

For ambitious employees, growth opportunities matter more than salary bumps.

Learning and Development:

- Tuition reimbursement

- Professional certification support

- Conference access

- Leadership development programs

Strategic Note: Pair development benefits with service commitments (e.g., “fund your MBA if you stay 2 years after graduation”). It’s a win-win for both you and the employee.

5. Lifestyle and Convenience Benefits: The Daily Value Drivers

These perks are part of employees' everyday lives, making a big impact on their overall experience.

Daily Convenience:

- Commuter benefits

- Company vehicles

- Free parking

- On-site meals or meal stipends

Family Support:

- Childcare assistance

- Elder care support

- Pet insurance

- Relocation assistance

Lifestyle Perks:

- Home office stipends

- Tech upgrades

- Phone and internet reimbursement

Strategic Note: Tailor lifestyle benefits to your workforce demographics. Remote teams need home office stipends; city workers need transit perks.

6. Recognition and Unique Perks: The Culture Differentiators

These benefits aren’t always big-ticket items, but they create emotional connections and strengthen your employer brand.

Recognition Programs:

- Service awards

- Performance bonuses

- Peer recognition

- Company retreats

Unique Workplace Perks:

- Bring-your-pet-to-work policies

- Volunteer time off

- Birthday PTO

- Mental health days

Strategic Note: Make recognition visible. A spot bonus presented in a team meeting has far more impact than one that’s quietly given behind closed doors.

Indirect compensation isn't a one-size-fits-all approach. It’s about offering the right benefits that speak to the diverse needs of your employees and reinforce your company’s culture. Here’s where most compensation strategies fail: execution.

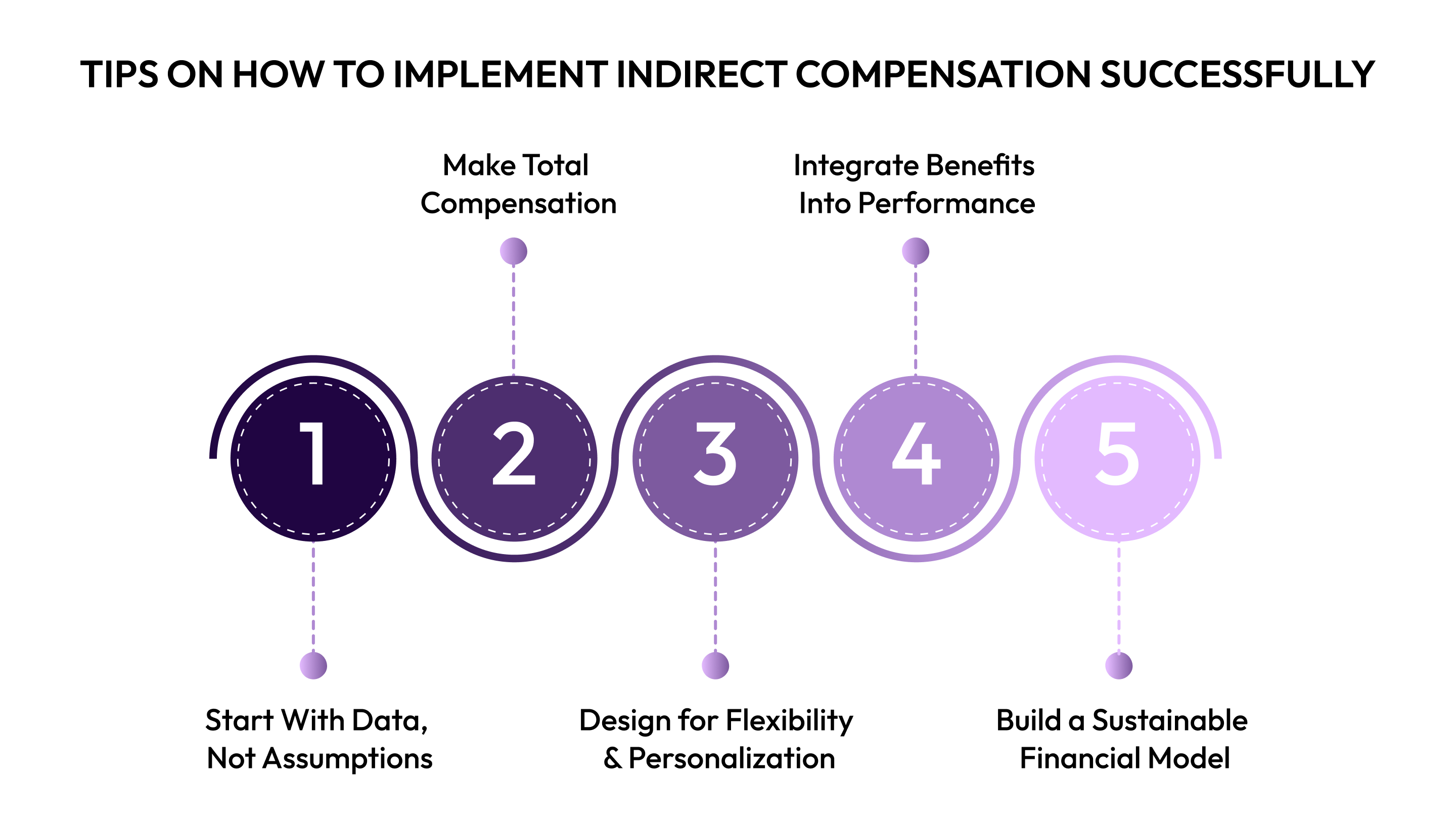

Tips On How to Implement Indirect Compensation Successfully

Your utlization stays low, employees still leave for "better benefits," and you start questioning ROI. The issue isn’t your benefit selection; it’s how you implement them. Successful programs are built on five key pillars that turn benefits from mere line items into real retention drivers.

1. Start With Data, Not Assumptions

The quickest way to waste your benefits budget is by guessing what employees want. Instead, do your homework:

- Survey employees across teams, tenure levels, and life stages.

- Analyze current benefits data—what’s being used, and what’s not?

- Check exit interview data for compensation mentions.

- Benchmark against competitors in your industry, not just general market trends.

Track metrics that matter like satisfaction, utilization rates, time-to-fill, and retention. These insights show if your investment is paying off. Platforms like CandorIQ unify compensation and benefits data into dashboards, enabling real-time insights into the link between benefit investments and retention outcomes.

2. Make Total Compensation Impossible to Ignore

The biggest mistake? Offering great benefits no one knows about. Make sure employees understand what they’re getting.

- Create total compensation statements that show both salary and the value of benefits.

- Include total compensation summaries in offer letters.

- Highlight benefits in onboarding—give new hires a clear understanding of their options.

- Communicate consistently through emails and Slack reminders about underused programs.

When employees see the true value of their benefits, they’re more likely to stay and appreciate the full offer.

3. Design for Flexibility and Personalization

One-size-fits-all benefits no longer cut it. Tailor your offerings to the diverse needs of your team.

- Flexible benefits platforms allow employees to choose what works for them.

- Offer opt-up or opt-down options so employees can personalize coverage.

- Adjust benefits based on life stages, like extra parental leave for new parents or retirement planning as employees near retirement.

- Geo-adjust benefits, make sure benefits are relevant to where employees live (e.g., different benefits in SF vs. Des Moines).

When benefits are personalized, employees feel more connected to them.

4. Integrate Benefits Into Performance and Culture

Benefits shouldn’t just be an HR function, they need to be woven into your culture.

- Train managers to advocate for benefits. They should be able to talk about vesting milestones, PTO increases, and how to use underutilized benefits.

- Tie benefits to performance and tenure with things like tenure-based PTO increases or performance-triggered bonuses.

- Make benefits part of your culture. Managers should model benefit usage, and employees should be encouraged to take advantage of them.

The goal is to make benefits a natural part of your work environment, not something employees just check off during onboarding.

5. Build a Sustainable Financial Model

Benefits programs need to grow sustainably or they’ll get cut. Create a plan that can scale.

- Establish clear budget frameworks. Set a target for what benefits should cost as a percentage of total compensation.

- Negotiate with vendors for better pricing and revisit contracts regularly.

- Plan for scaling—as your team grows, per-employee costs should go down.

- Create cost-sharing transparency so employees understand what you're contributing.

- Roll out new benefits gradually and use pilot programs to test before committing long-term.

When you do this right, indirect compensation stops being a cost center and becomes a strategic asset. It impacts offer acceptance rates, retention, and, ultimately, business results.

Also Read: Top Compensation Management Strategies for Employee Retention

Conclusion

Indirect compensation is a financial lever that directly impacts retention economics and talent quality. The organizations outpacing competitors aren't spending more on benefits; they're spending smarter, with a clear line-of-sight between investment and outcomes.

The challenge? Most compensation planning tools weren't built for this complexity. Fragmented systems create visibility gaps exactly where strategic decisions happen.

CandorIQ connects compensation planning, benefits modeling, and workforce analytics in one platform, giving finance and HR leaders the clarity to optimize total rewards investment.

If you're managing comp strategy across distributed teams or preparing for your next board presentation on talent spend, book a demo to see how CandorIQ eliminates the visibility gaps holding your strategy back.

Frequently Asked Questions

1. Is indirect compensation taxable?

It depends on the benefit type. Health insurance premiums paid by employers are typically tax-free. Retirement contributions to 401(k)s are tax-deferred. However, some benefits like gym memberships, company car personal use, and certain bonuses may be taxable. The IRS treats different benefits differently, so consult your tax advisor for specific situations.

2. Can employees negotiate indirect compensation?

Absolutely. While many benefits are standardized company-wide, candidates can often negotiate signing bonuses, additional PTO days, remote work arrangements, professional development budgets, relocation assistance, and equity grants. It's especially effective when base salary has constraints, but benefits have flexibility.

3. What's the difference between indirect compensation and fringe benefits?

These terms are often used interchangeably, but technically, fringe benefits are a subset of indirect compensation. Fringe benefits typically refer to extra perks beyond standard benefits (like company cars or gym memberships), while indirect compensation encompasses all non-cash rewards, including mandatory benefits like health insurance and retirement plans.

4. How often should companies review their indirect compensation packages?

Conduct a comprehensive review annually, but monitor key metrics quarterly. Benchmark against competitors during major hiring pushes, after significant turnover events, or when entering new markets. Benefits, costs, and employee needs shift constantly, making static programs uncompetitive quickly.

Ready modernize your workforce and compensation strategy?

See how CandorIQ brings workforce planning and compensation together with AI.