How to Analyze Employee Wage and Benefit Costs

Analyze employee wage and benefit costs, define total compensation, break down wages, and forecast trends. Conduct regular reviews. Boost ROI now!

Are you accurately tracking the total cost of your workforce?

Understanding the true cost of employees is a key factor for any HR leader, CFO, or People Manager aiming to optimize compensation, drive employee engagement, and ensure budget efficiency. According to the U.S. Bureau of Labor Statistics, the average employer cost for civilian workers was $47.92 per hour worked in March 2025, with wages and salaries accounting for $32.92 and benefits adding another $15.00.

But it doesn’t stop there. In countries like the UK, where labor costs have risen by an average of 4.6% in the past year, businesses are feeling the strain as they try to balance competitive pay with sustainability. This makes it more important than ever for organizations to get a clear view of their employee wage and benefit costs.

For HR leaders and CFOs, analyzing these costs is no longer just about ensuring budgets stay on track. It’s about ensuring your workforce is motivated, valued, and positioned for success.

This article will help you understand how to analyze employee wage and benefit costs effectively, and why this practice is essential for long-term growth and business sustainability.

Key Takeaways

- Employee wage and benefit costs extend beyond salary, encompassing bonuses, health benefits, retirement contributions, and other indirect costs.

- Performing a comprehensive cost analysis helps organizations make informed decisions, ensuring financial sustainability while remaining competitive in the talent market.

- Key variables such as location, company size, industry, and turnover rates can significantly impact the total employee cost.

- Regular benchmarking against industry standards and internal equity analysis ensures that compensation remains fair, competitive, and aligned with market trends.

- Implementing the right tools and methodologies, like HRIS and data analytics, streamlines the cost analysis process and provides valuable insights for strategic decision-making.

Understanding the Full Scope of Employee Compensation

Employee compensation extends beyond the base salary to encompass a variety of direct and indirect costs. These elements collectively form the total cost of employment, which is crucial for accurate financial planning and strategic decision-making.

- Direct Compensation Costs: Direct compensation refers to the salary or wages employees are paid for their work, along with any additional monetary incentives. While base salary is often the most visible expense, there are other performance-based rewards that contribute to the total cost of compensation.

- Indirect Compensation Costs: Indirect compensation includes the range of benefits and perks provided to employees, like health insurance, retirement contributions, and other allowances. These costs, although not immediately apparent, contribute heavily to the overall employee cost and must be accounted for during cost analysis.

Understanding these components allows organizations to assess the true cost of employing each individual and make informed decisions regarding compensation strategies.

Having understood direct and indirect costs, let’s dive deeper into the strategic importance of cost analysis itself and why it plays a pivotal role in shaping HR decisions.

Why Cost Analysis Matters

Performing a cost analysis on HR wage and benefits isn’t just about tracking expenses. It’s about strategic alignment and ensuring that your compensation structure supports your business goals. Here’s why it’s essential:

- Financial Planning and Budgeting: A clear understanding of employee wage and benefit costs allows businesses to create realistic budgets. By reviewing total compensation, HR and finance teams can ensure that employee-related costs align with forecasted revenue and growth.

- Staying Competitive in the Job Market: Employee wages and benefits are a key part of your employee value proposition (EVP). If compensation isn’t competitive with industry standards, attracting top talent becomes difficult. Cost analysis helps benchmark your offerings against competitors, ensuring your company remains an attractive option for potential recruits.

- Optimising Resource Allocation: Without accurate analysis, businesses may over-invest in certain benefits while neglecting others that employees value more. For instance, allocating too much budget to expensive health insurance premiums might be inefficient if employees would prefer more investment in professional development or flexible work arrangements.

- Employee Retention: Employees who feel their wages and benefits are fair and aligned with their efforts are more likely to remain with the company long-term. An analysis helps ensure fairness and equity across the workforce, addressing potential pay disparities before they cause dissatisfaction or turnover.

- Compliance and Risk Management: Wage and benefit costs are subject to ever-evolving tax laws, minimum wage legislation, and other regulations. Regular analysis ensures that your organization remains compliant, mitigating the risk of legal challenges or penalties.

Suggested read: Top Compensation Management Strategies for Employee Retention

Now that we understand why cost analysis is vital, let’s explore the various factors that influence employee cost beyond just salary and benefits. Understanding these variables allows HR teams to make more informed decisions.

8 Factors That Impact Employee Wage

When analyzing employee wage and benefit costs, it’s essential to consider several variables that directly influence these expenses. These factors go beyond basic salary and benefits and have significant effects on your overall compensation strategy. Here are the 8 key variables that can impact the total employee cost within an organization.

1. Location

One of the most significant factors affecting employee cost is location. Employees in different geographical areas often have varying salary expectations based on the cost of living and market salary standards in that region.

For example, a role based in a high-cost city like San Francisco may require higher compensation compared to the same role in a smaller, less expensive region.

Pay scales, benefits packages, and incentives often vary depending on location, and companies may adjust compensation accordingly to remain competitive in the local job market.

2. Industry

The industry in which a company operates plays a critical role in determining employee compensation. Highly competitive industries like technology, finance, and pharmaceuticals tend to offer higher salaries and more attractive benefits to attract top talent, whereas sectors such as retail or hospitality may have lower wage standards.

Companies in high-demand industries must offer competitive wages and benefits to attract and retain skilled employees, while companies in less competitive industries may focus more on job stability and benefits to remain attractive to workers.

3. Company Size

The size of the company can significantly influence employee costs. Large organizations often have larger budgets for employee compensation and can afford to offer competitive wages and extensive benefits packages. Smaller companies or startups may have to be more creative, offering other perks like flexible working hours, professional development opportunities, or profit-sharing schemes in lieu of high salaries.

As a company grows, the complexity of managing payroll, benefits, and other employee-related expenses increases, necessitating more advanced systems and greater administrative overhead.

4. Market Conditions

Market conditions are a reflection of the current economic climate and industry trends, including inflation rates, unemployment rates, and the overall job market demand for specific roles. A tight labor market, where skilled talent is scarce, can drive up wages and benefits, while a saturated job market may lead to a decrease in compensation packages.

Keeping an eye on economic trends and job market conditions helps HR teams adjust compensation plans to meet market demands and remain competitive. The cost of living is also a vital factor in determining market-adjusted wages.

5. Turnover Rates

High employee turnover can significantly impact employee costs. When turnover rates are high, organizations spend more on recruitment, onboarding, and training new employees. Additionally, if a company has a high turnover, it may need to offer higher salaries or additional benefits to keep talent engaged and reduce churn.

High turnover rates usually correlate with poor employee satisfaction, and addressing root causes—such as lack of growth opportunities or insufficient compensation—can help lower overall employee costs.

6. Unions

Unions can have a profound impact on employee costs, as they often negotiate on behalf of employees for better pay, benefits, and working conditions. In unionized environments, businesses must consider union contracts that set wage standards, benefits packages, and working conditions.

While unionized workers may have higher salary demands, the stability and predictability of wages and benefits can also help reduce turnover and improve employee retention, thus balancing the increased upfront costs.

7. Roles and Tasks

Different roles and responsibilities come with varying levels of skill requirements and complexity. Senior executives or specialized technical roles typically command higher salaries due to the expertise and experience required. The more complex or mission-critical the role, the higher the potential compensation.

Ensuring that compensation aligns with the complexity and value of the role is essential to retaining the right talent. Roles that are essential to business continuity or contribute directly to revenue generation tend to have higher compensation packages.

8. Performance

Employee performance is another crucial variable that impacts compensation costs. Organizations often link performance to compensation through bonuses, incentives, and merit-based raises. High-performing employees may receive higher bonuses or base salary increases, while underperforming employees may not be compensated as generously.

Regular performance evaluations are essential for ensuring that compensation reflects individual contributions. By tying performance metrics to compensation, companies can incentivize employees to achieve business goals, directly influencing the company’s financial health.

With these variables in mind, let’s now turn our attention to the calculations that should be considered when analyzing employee costs, which often extend beyond direct and indirect compensation.

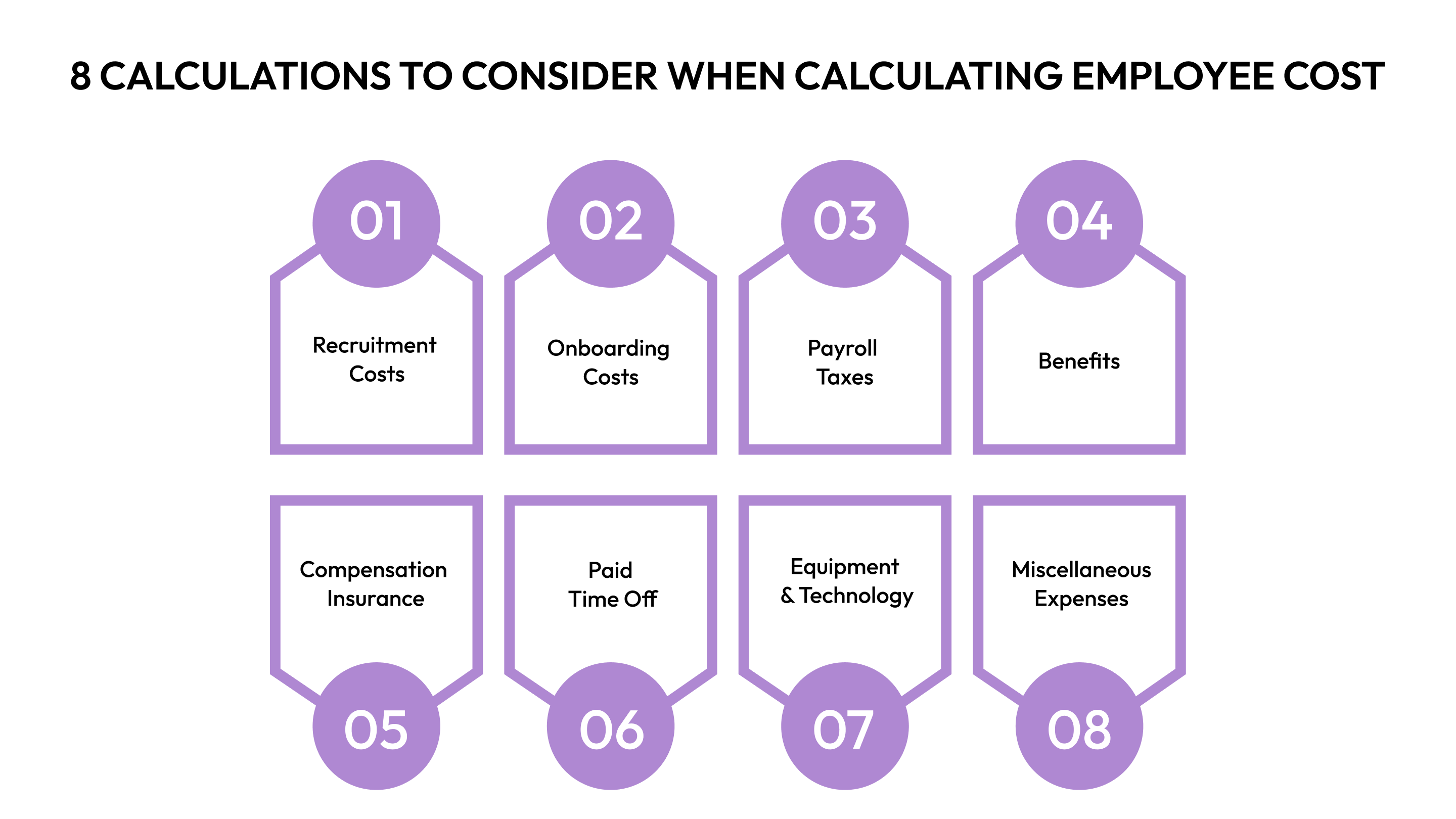

8 Calculations to Consider When Calculating Employee Cost

Understanding the full financial impact of an employee requires more than just adding up their salary. Several additional expenses contribute to the total cost of employment, and overlooking any of them can lead to budgetary surprises. Here's a breakdown of the key expenses HR leaders, CFOs, and People Managers should consider:

1. Recruitment Costs

Hiring new employees involves various expenses beyond advertising job openings. These can include:

- Job Posting Fees: Costs associated with listing positions on job boards or company websites.

- Recruitment Agency Fees: If using external agencies, fees can range from 15% to 30% of the employee's first-year salary.

- Internal HR Time: The time spent by HR staff on screening, interviewing, and selecting candidates.

2. Onboarding Costs

Effective onboarding ensures new hires integrate smoothly into the company. Expenses here may encompass:

- Training Materials: Costs for resources and tools used during training sessions.

- Workspace Setup: For remote employees, this might include stipends for home office equipment.

- Administrative Time: Time spent by HR and managers to complete paperwork and orientation processes.

3. Payroll Taxes

Employers are responsible for various payroll taxes, which can vary by jurisdiction. Common taxes include:

- Social Security and Medicare: In the U.S., employers match employee contributions.

- Federal and State Unemployment Taxes (FUTA and SUTA): Rates and wage bases differ by state.

- Other Local Taxes: Depending on the location, there may be additional taxes to consider.

4. Benefits

Offering a comprehensive benefits package is crucial for attracting and retaining talent. Typical benefits include:

- Health Insurance: Employer contributions to employee premiums.

- Retirement Plans: Contributions to 401(k) or pension plans.

- Other Benefits: Life insurance, disability coverage, and wellness programs.

5. Workers' Compensation Insurance

This insurance provides medical benefits and wage replacement to employees injured on the job. The cost is influenced by:

- Industry Risk Level: Higher-risk industries pay more.

- Employee Roles: Jobs with higher injury rates increase premiums.

- State Regulations: Each state has its own rates and requirements.

6. Paid Time Off (PTO)

Employees accrue paid leave, which represents a cost to the employer. This includes:

- Vacation Days: Paid time off for rest and recreation.

- Sick Leave: Paid time off for illness.

- Holidays: Paid days off for recognized public holidays.

7. Employee Equipment and Technology

Providing the necessary tools for employees to perform their jobs involves costs such as:

- Computers and Software: Laptops, desktops, and necessary software licenses.

- Communication Tools: Phones, collaboration platforms, and internet stipends.

- Office Supplies: Desks, chairs, and other ergonomic equipment.

8. Miscellaneous Expenses

Additional costs that can accumulate include:

- Bonuses and Incentives: Performance-based rewards to motivate employees.

- Uniforms and Uniform Care: If applicable, costs for providing and maintaining uniforms.

- Employee Perks: Coffee, snacks, or other small amenities provided in the workplace.

Now that we understand why it’s important, let’s look at how to approach cost analysis for employee wages and benefits.

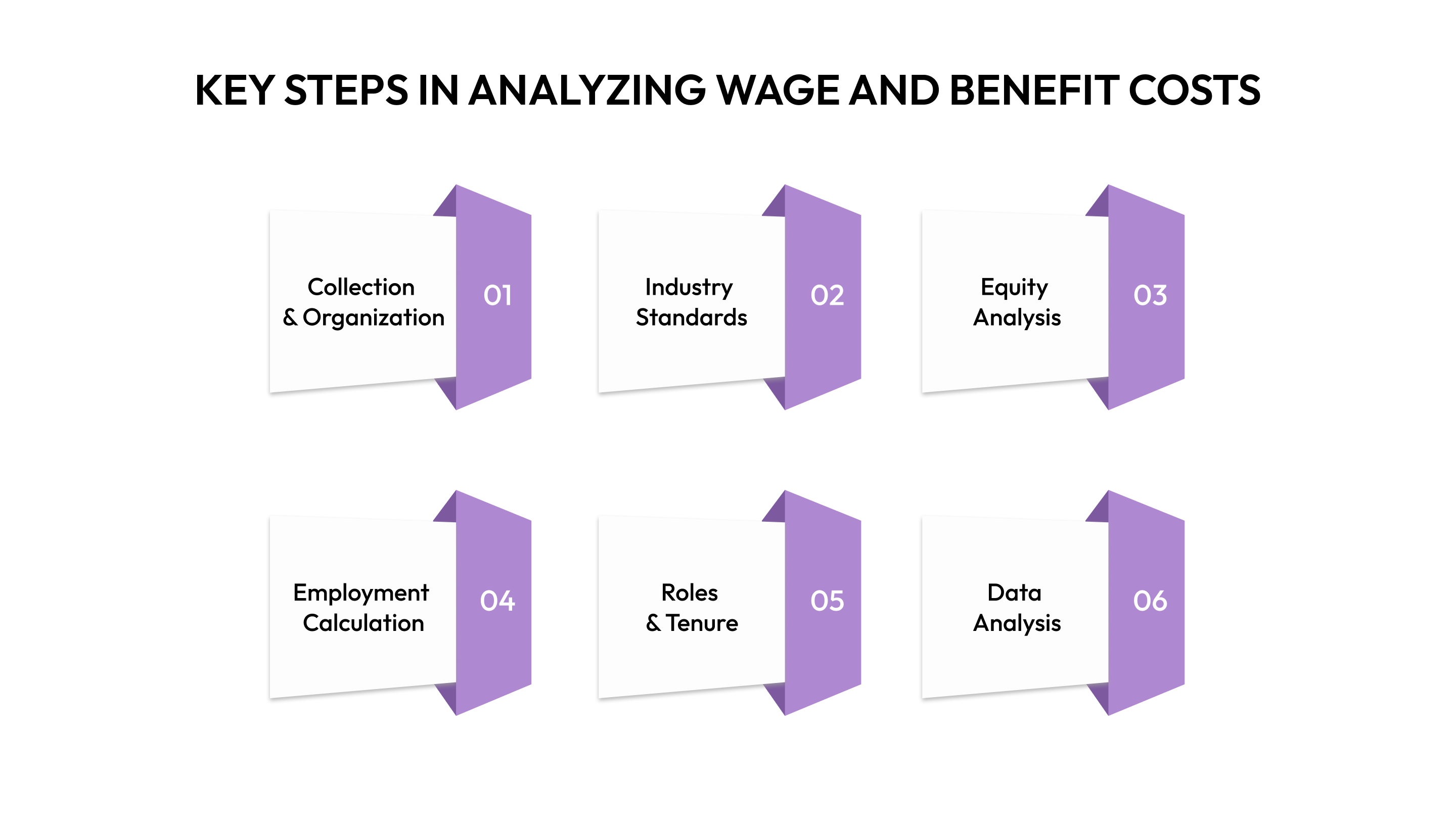

Key Steps in Analyzing Wage and Benefit Costs

A thorough and well-executed compensation cost analysis requires a structured methodology to ensure that all relevant data is accurately collected, evaluated, and used to make informed decisions.

By leveraging the right methodologies, HR leaders and CFOs can gain a clear picture of how much they are investing in their workforce and whether that investment is yielding the desired returns.

Here are the key methodologies to follow when conducting an effective cost analysis of HR wage and benefits.

1. Data Collection and Organization

The first step in any compensation cost analysis is gathering comprehensive, accurate data. The quality of your analysis is only as good as the data it’s based on, so it’s essential to ensure all relevant information is captured and organized.

- Centralized Systems: Use an HRIS (Human Resource Information System) to centralize employee records, salary data, benefits information, and performance metrics. This makes it easier to access, manage, and analyze the data.

- Data Categories: Break the data into key categories such as base salary, bonuses, benefits, and PTO. Make sure that you’re collecting details on indirect costs like employee development and wellness programs as well.

- Accuracy and Consistency: Regularly audit your data for completeness and consistency. Errors or outdated records can skew your analysis and lead to inaccurate conclusions.

2. Benchmarking Against Industry Standards

One of the most effective ways to assess the competitiveness of your compensation offerings is by comparing your data to industry standards. Benchmarking enables you to gauge where your organization stands relative to competitors and determine if your wage and benefit offerings align with current market trends.

- Salary Surveys: Use reputable salary surveys and industry reports to gather information on market compensation for similar roles in your geographic region. This helps you identify any discrepancies between your compensation strategy and what is considered competitive in the market.

- Benchmarking Tools: Platforms like Glassdoor provide detailed salary data across industries and locations. These tools help you compare your wages with the broader industry to see how well you’re positioned.

- External Factors: Don’t just focus on salary—look at the benefit structures offered by competitors. Benefits like health insurance, retirement plans, and stock options play a huge role in employee satisfaction and retention.

3. Internal Equity Analysis

After gathering external benchmarks, the next step is to ensure internal equity. This is about ensuring that employees within your organization are paid fairly relative to their roles, experience, and performance. Internal equity plays a major role in employee satisfaction and retention.

- Role Comparisons: Compare compensation for employees in similar roles or departments. Use job grades and levels to assess if employees in comparable positions are being compensated equitably.

- Experience and Seniority: Ensure that employees with similar levels of experience, education, and seniority receive appropriate compensation.

- Geographic Considerations: If you have multiple locations, ensure that pay scales are adjusted for cost-of-living differences. A one-size-fits-all approach can result in pay disparities, especially if employees in different regions are performing the same work.

4. Total Cost of Employment Calculation

A comprehensive compensation cost analysis should go beyond salary and take all direct and indirect compensation costs into account. This includes calculating the total cost of employing someone, which helps you understand the full financial impact of each employee.

- Total Compensation: Add base salary, bonuses, and performance incentives to the cost of providing benefits, health insurance, and retirement contributions. Include non-financial benefits like professional development programs, gym memberships, and wellness stipends.

- Onboarding and Training: Factor in the costs of hiring, onboarding, and training new employees, as well as employee development costs for existing staff.

- Attrition and Replacement Costs: Don’t forget to account for the costs of employee turnover—recruitment, training, and productivity losses associated with hiring new employees.

Also read: Building a Market Competitive Pay Structure: Essential Guide

5. Comparing Across Departments, Roles, and Tenure

Your compensation structure should be balanced and equitable across the entire organization. Conducting an in-depth analysis of wage and benefit costs across different departments, roles, and employee tenures helps to identify potential issues in compensation distribution.

- Departmental Comparison: Compare compensation between departments to ensure fairness and that employees are compensated according to their job responsibilities, performance, and market value.

- Role Comparison: Make sure roles with similar responsibilities and outcomes are compensated similarly, even if they’re in different teams or departments.

- Tenure-Based Analysis: Assess whether employees with more experience or longer tenure are being rewarded appropriately for their loyalty and contributions.

6. Data Analysis and Reporting

The final step involves analyzing the collected data and generating actionable insights. This is where technology and tools come into play. HR software and analytics tools can help uncover trends and highlight areas of improvement.

- Data Visualization: Use visualization tools such as graphs, charts, and heat maps to make the data more digestible for stakeholders. For example, you can use charts to show salary distribution or visualize the breakdown of benefits costs.

- Trend Identification: Look for trends or anomalies in the data, such as areas where wages are consistently below market rates or where benefits are underutilized. Identify opportunities for improvement or potential risks related to employee satisfaction or retention.

Conclusion

Cost analysis of HR wage and benefits is a critical component of strategic HR management. It helps organizations ensure that their compensation strategies are aligned with their financial goals, competitive within the market, and fair to employees. By collecting the right data, benchmarking against industry standards, and using the right tools, HR leaders can make informed decisions that benefit both the company’s bottom line and its employees.

CandorIQ offers a comprehensive, data-driven solution for streamlining compensation and benefits management. With its advanced AI-powered insights, real-time data analytics, and seamless integration, CandorIQ helps HR leaders and CFOs optimize employee costs while ensuring fairness and alignment with company goals.

Ready to optimize your employee cost management? Book your demo today and discover how it can revolutionize your compensation strategy.

FAQs

1. How can employee benefits influence overall compensation costs?

Employee benefits, such as healthcare, retirement plans, and bonuses, often account for a significant portion of compensation expenses. When analyzing employee costs, it's important to evaluate the efficiency of the benefits package and ensure it aligns with employee preferences and company financial goals.

2. What is the impact of remote work on employee cost analysis?

Remote work can affect employee costs in several ways, including the need for remote-specific benefits like home office stipends or technology allowances. These factors should be included in cost analysis to assess whether the remote work model is cost-effective and competitive compared to traditional office settings.

3. How does regulatory compliance affect employee cost calculations?

Changes in labor laws, tax regulations, and benefits mandates can directly influence employee costs. Organizations must account for these shifts when analyzing compensation to ensure they are meeting legal requirements while managing costs effectively.

4. How do performance-based incentives impact employee cost analysis?

Performance-based incentives such as bonuses, stock options, and profit-sharing plans add variability to employee costs. These incentives should be carefully monitored and aligned with both company performance and employee contributions to ensure they provide value without escalating costs unnecessarily.

5. How can long-term employee retention strategies reduce overall employee costs?

Developing long-term retention strategies, such as career development programs and succession planning, can reduce turnover-related expenses. By investing in employee growth and satisfaction, companies can lower recruitment, training, and onboarding costs while maintaining a more experienced and stable workforce.

Ready modernize your workforce and compensation strategy?

See how CandorIQ brings workforce planning and compensation together with AI.